In the vibrant garden of assets, the attraction of metals like gold continues to be staunch. Capitalists finding reliability, variation, and a hedge versus economic unpredictabilities commonly count on Gold Individual Retirement Accounts (IRAs). As our team navigate by means of the financial investment alternatives on call in 2024, one business that sticks out is actually Outlook India. Within this article, our team will certainly explore the features, advantages, as well as general performance of Outlook India, clarifying why it’s considered some of the utmost options for Gold IRA investments.

The Importance of Gold in Investment Portfolios:

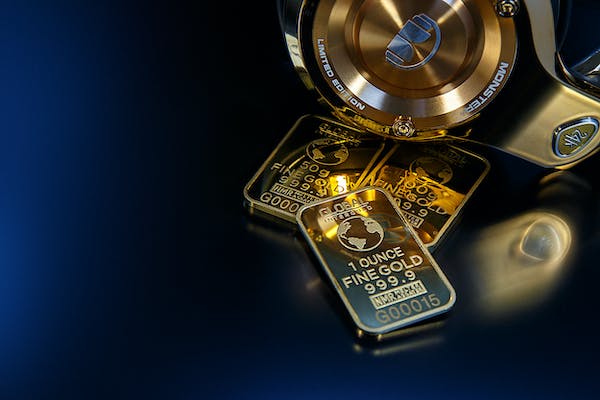

Gold has actually long been worshiped for its own innate worth and also part as a safe-haven resource. Eventually of economic disturbance as well as market dryness, gold has in the past illustrated its own capacity to retain worth and serve as a trusted retail store of wealth. Investors are actually considerably recognizing the importance of combining gold into their portfolios to reduce danger and also enhance total diversification.

Outlook India’s Commitment to Excellence:

In the reasonable realm of Gold IRA business, Outlook India has regularly proven itself as a frontrunner. Recognized for its own dedication to distinction, this provider has actually gotten interest for its own comprehensive strategy to assisting real estate investors safeguard their retired life savings with the incorporation of gold in their profiles.

Secret Features of Outlook India:

Professional Guidance:

Overview India differentiates itself through giving experienced guidance throughout the whole financial investment procedure. Their crew of professional experts provides personalized insight, ensuring that investors make updated selections straightened along with their monetary targets as well as run the risk of resistance.

Diverse Investment Options:

Comprehending that each client possesses one-of-a-kind inclinations, Outlook India offers a variety of investment choices within the gold and silvers spectrum. This diversity permits clients to adapt their portfolios to comply with specific requirements as well as market conditions.

Translucent Fee Structure:

Clarity is crucial in the expenditure business, as well as Outlook India promotes this guideline through sustaining a crystal clear as well as translucent fee framework. Financiers may confidently navigate their investments, understanding the expenses linked with handling their Gold IRA.

Safety and Storage:

Outlook India places a powerful focus on the protection and storage space of bodily gold. With cutting edge facilities and also strict protection actions, investors may rely on that their gold and silvers are well-protected, giving them assurance in unclear opportunities.

Expectation India’s Market Performance:

In the ever-evolving financial yard of 2024, Outlook India continues to illustrate strength and flexibility. Through very closely keeping an eye on market fads as well as using strategic financial investment methods, this company has achieved success in aiding its customers navigate the challenges presented through financial changes.

The Outlook India Advantage:

Danger Mitigation:

Gold’s particular market value as well as historical efficiency result in helpful threat minimization in investors’ portfolios. Overview India’s importance on gold investments provides an unique conveniences in securing retired life savings coming from the influence of market recessions.

Long-Term Growth Potential:

Outlook India positions on its own as a long-lasting companion for real estate investors looking for continual development. The incorporation of gold in a diversified profile can contribute to secure, long-lasting yields, straightening with the retired life goals of lots of investors.

Adaptability to Market Trends:

The ability to adapt to altering market states is actually a hallmark of Outlook India’s success. Via constant investigation and evaluation, the company stays ahead of fads, enabling real estate investors to produce well informed choices in an ever-evolving financial landscape.

The Outlook India Difference:

Educational Resources:

Expectation India does not simply help with assets; it likewise focuses on investor education. Realizing the usefulness of educated decision-making, the company offers a wide range of educational information. From market insights to investment approaches, real estate investors can easily access useful information that empowers all of them to navigate the ins and outs of the rare-earth elements market with confidence.

Client Support:

The trademark of any respectable financial institution is exceptional client support. Overview India comprehends the significance of reactive, client-centric company. Financiers can rely upon a specialized client assistance staff to deal with concerns immediately, encouraging a partnership built on trust fund and also dependability.

The Outlook India Commitment to Sustainability:

In a time where environmental, social, as well as control (ESG) variables take on a crucial role in financial investment selections, Outlook India differentiates on its own through combining lasting techniques. The firm places usefulness on ethically sourced components, accountable exploration strategies, as well as environmentally self-conscious initiatives, straightening its operations with the expanding requirement for socially liable investing.

Attitude India’s Vision for the Future:

Intending, Outlook India envisions a future where gold remains to play a core job in diversified investment portfolios. The provider is positioned to adjust to emerging market styles, technical innovations, and also governing adjustments, making sure that clients get the most applicable and also current strategies to get their monetary futures.

Capitalist Testimonials:

Real step of a Gold IRA company’s results depends on the fulfillment and also results of its own real estate investors. Good reviews from completely satisfied customers emphasize Outlook India’s effectiveness in aiding individuals obtain their retired life objectives. Entrepreneurs applaud the business’s dedication to openness, stability, and the tailored method it needs to assist them with the complications of the rare-earth elements market.

The Outlook India Advantage in 2024 and Beyond:

As our team browse the obstacles and chances of 2024, Outlook India’s commitment to providing a safe and flourishing future for its investors remains undeviating. The firm’s focus on diversification, openness, as well as sustainability sets it apart in the very competitive yard of Gold IRA providers.

The Future of Gold IRAs and Outlook India’s Role:

As our team look ahead to the future of Gold IRAs, the job of rare-earth elements in varied assets profiles is actually likely to become much more evident. Financial gardens develop, and also geopolitical unpredictabilities persist, making it critical for clients to have resilient approaches in position. Expectation India, with its own critical approach and also devotion to staying at the leading edge of market trends, placements on its own as a principal in shaping the future of Gold IRAs.

Technical Integration:

Outlook India identifies the value of staying highly relevant. The provider frequently integrates cutting-edge technologies to streamline the financial investment method, making sure that investors have accessibility to real-time data, protected transactions, as well as an user-friendly interface. This commitment to technical development improves the general client adventure and jobs Outlook India as a forward-thinking company.

Global Economic Trends:

Maintaining an alert eye on worldwide financial trends, Outlook India is actually well-prepared to adjust its own strategies to altering market characteristics. By very closely checking geopolitical advancements, unit of currency variations, and also business styles, the provider makes certain that real estate investors are actually geared up with the insights required to navigate the complexities of the international economic landscape.

Regulatory Compliance:

Regulative modifications can dramatically impact the assets landscape. Outlook India’s devotion to regulatory conformity ensures that its functions coordinate along with developing economic guidelines. This dedication not simply safeguards clients but additionally supports the provider’s credibility for ethical business practices.

Result:

As financiers chart their course in 2024, the charm of Outlook India as a Gold IRA provider is evident. With a devotion to excellence, clear methods, as well as a pay attention to delivering diversified, protected investment alternatives, Outlook India has become a leading option for those finding to strengthen their retired life profiles along with the long-lasting worth of gold. As our company navigate the complexities of the financial planet, Outlook India stands up as a guidepost, guiding real estate investors in the direction of a protected and prosperous retirement life future.