Gold Individual Retirement Account Financial Investment: Whatever You Need to Know

A gold IRA, or individual retirement account, is a sort of self-directed IRA that allows you to purchase physical gold bullion and various other precious metals. Gold IRAs use a variety of prospective benefits, consisting of diversity, rising cost of living defense, and economic security. Nevertheless, there are additionally some potential drawbacks to think about prior to investing in a gold individual retirement account

What is a Gold individual retirement account?

A gold IRA is a type of self-directed individual retirement account (INDIVIDUAL RETIREMENT ACCOUNT) that permits you to gold IRA investing bullion and various other rare-earth elements. Gold IRAs are similar to standard and Roth IRAs, but they offer the included advantage of diversification and prospective protection against rising cost of living and financial instability.

Exactly how Does a Gold IRA Job?

To purchase a gold individual retirement account, you will require to open up an account with a gold individual retirement account custodian. A gold IRA custodian is a banks that concentrates on holding and taking care of physical rare-earth elements for individual retirement account accounts. When you have actually opened up an account, you can buy gold IRA products from a reputable gold dealership. Your gold individual retirement account custodian will after that keep your gold in a protected vault.

Benefits of Buying a Gold IRA.

There are a number of possible benefits to investing in a gold IRA:

- Diversity: Gold is a distinct possession class that is not correlated with the supply and bond markets. This means that adding gold to your retirement portfolio can aid to minimize your general threat.

- Rising cost of living defense: Gold has historically held its worth well during durations of inflation. This is because gold is a finite resource and its worth is not connected to any government or reserve bank.

- Economic stability: Gold is frequently seen as a safe house property during times of economic instability. This is because gold is relatively simple to store and transportation, and it is widely approved as a kind of settlement.

- Tax obligation advantages: Gold IRAs provide the same tax benefits as traditional and Roth IRAs. This suggests that you can add pre-tax or after-tax dollars to your account, and your revenues can grow tax-deferred or tax-free till you withdraw them in retirement.

Downsides of Purchasing a Gold individual retirement account

There are additionally some potential disadvantages to think about prior to buying a gold individual retirement account:

- Higher fees: Gold IRAs usually have greater charges than standard and Roth IRAs. This is since gold IRAs call for the acquisition and storage of physical rare-earth elements.

- Reduced returns: Gold has traditionally underperformed the securities market over the long-term. This indicates that you may not gain as high of a return on your financial investment in gold as you would if you bought stocks.

- Liquidity concerns: Gold can be a hard property to sell swiftly. If you require to access your cash promptly, you may have to offer your gold at a discount.

- Storage worries: Gold is a physical possession, so you will certainly need to keep it in a secure location. This can be expensive and bothersome.

How to Choose a Gold IRA Custodian

When picking a gold individual retirement account custodian, it is important to think about the following elements:

Credibility: Pick a custodian with a great track record and a long track record of success.

Charges: Contrast the fees billed by different custodians.

Solutions: Take into consideration the solutions offered by different custodians, such as the sorts of gold items they provide and exactly how they keep and guarantee your gold.

How to Set Up a Gold individual retirement account

Once you have actually picked a gold individual retirement account custodian, you can set up a gold IRA account by adhering to these actions:

- Complete an application with your custodian.

- Fund your account with pre-tax or after-tax dollars.

- Choose the gold products you wish to purchase.

- Acquisition your gold items with your custodian.

- Your custodian will after that store your gold in a protected vault.

Just how to Purchase Gold Individual Retirement Account Products

Once you have opened a gold IRA account, you can invest in a selection of gold items, including:

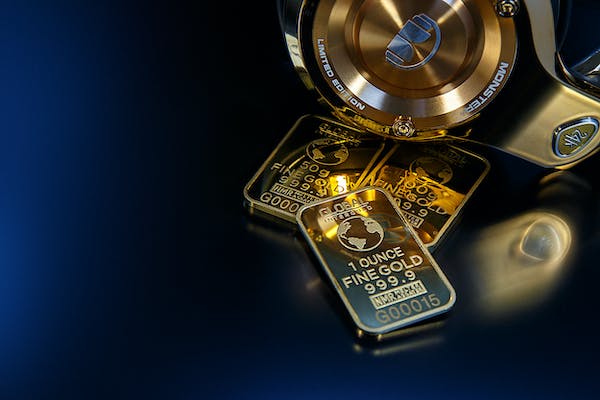

Gold coins: Gold coins are a preferred option for gold IRA capitalists because they are very easy to store and transportation.

Gold bars: Gold bars are one more preferred option for gold individual retirement account financiers since they are extra cost effective than gold coins.

Gold rounds: Gold rounds resemble gold coins, however they do not have a legal tender denomination.

Just How to Market Gold IRA Products

Once you have actually opened a gold IRA account, you can purchase a range of gold products, including gold coins, bars, and rounds. However, what if you require to sell your gold individual retirement account items? Here is a detailed guide on how to sell gold individual retirement account items:

1. Contact your gold individual retirement account custodian.

The primary step is to contact your gold IRA custodian. They will be able to supply you with info on the procedure of marketing your gold individual retirement account items. They will certainly likewise be able to tell you what charges are related to marketing your gold.

2. Determine just how you want to offer your gold.

There are 2 primary ways to offer gold individual retirement account products:

Sell to your gold individual retirement account custodian. This is one of the most usual way to offer gold IRA products. Your custodian will certainly purchase your gold at the existing market price and after that market it to a third-party gold dealer.

Market to a third-party gold supplier. You can additionally market your gold IRA items to a third-party gold dealer. Nevertheless, it is essential to pick a reputable dealer who is accredited and guaranteed.

3. Gather the essential documentation.

Before you can sell your gold individual retirement account products, you will need to collect the essential documentation. This consists of:

- Your gold IRA account number

- A checklist of the gold items you want to market

- The purchase days and rates of the gold products

- The present market value of the gold products

4. Ship your gold to your custodian or third-party gold dealer.

When you have collected the needed documentation, you will require to ship your gold to your custodian or third-party gold dealership. It is important to ship your gold making use of a safe and secure shipping approach, such as registered mail or insured delivery.

5. Obtain your settlement.

Once your custodian or third-party gold supplier has actually received your gold, they will process your settlement. You will usually receive your payment within a few days.

Crucial Considerations

Here are some essential points to keep in mind when marketing gold individual retirement account products:

Costs: There are charges connected with offering gold individual retirement account items. These fees differ from custodian to custodian and dealer to dealership. Be sure to contrast the charges billed by various custodians and suppliers before you market your gold.

Taxes: You may be liable for tax obligations on the sale of your gold IRA items. Make certain to seek advice from a tax obligation expert to determine your tax obligation liability.

Liquidity: Gold is a less liquid asset than stocks and bonds. This implies that it can be difficult to market gold rapidly. If you require to access your cash money rapidly, you might have to market your gold at a price cut.

Tips for Selling Gold IRA Products

Here are some ideas for offering gold individual retirement account items:

- Contrast prices from different custodians and suppliers. Get quotes from a number of custodians and dealerships before you sell your gold. This will help you to obtain the best feasible price for your gold.

- Sell your gold during times of high prices. Gold prices rise and fall gradually. If you require to market your gold, attempt to offer it throughout a time when prices are high.

- Think about offering your gold in installations. If you don’t require every one of your cash at the same time, think about marketing your gold in installations. This will certainly aid you to stay clear of selling every one of your gold at an affordable price.

Conclusion

Selling gold IRA items is a reasonably uncomplicated procedure. Nevertheless, it is important to comprehend the charges and taxes related to selling gold. It is also important to select a trusted custodian or third-party gold supplier. By adhering to the ideas above, you can make sure that you get the very best feasible rate for your gold IRA products.